Everything You Need to Learn About Offshore Investment for Global Wealth Development

Everything You Need to Learn About Offshore Investment for Global Wealth Development

Blog Article

The Top Factors for Thinking About Offshore Investment in Today's Economy

In the context these days's unstable financial landscape, the values of offshore investment warrant mindful consideration. Capitalists are progressively attracted to the chance for diversity past domestic boundaries, which offers to reduce threats related to local market variations. The possibility for tax obligation advantages and improved financial personal privacy can not be overlooked. As worldwide markets proceed to develop, recognizing the implications of these aspects becomes critical for tactical possession monitoring. What specific advantages could offshore investments offer your profile in the current climate?

Diversity of Investment Portfolio

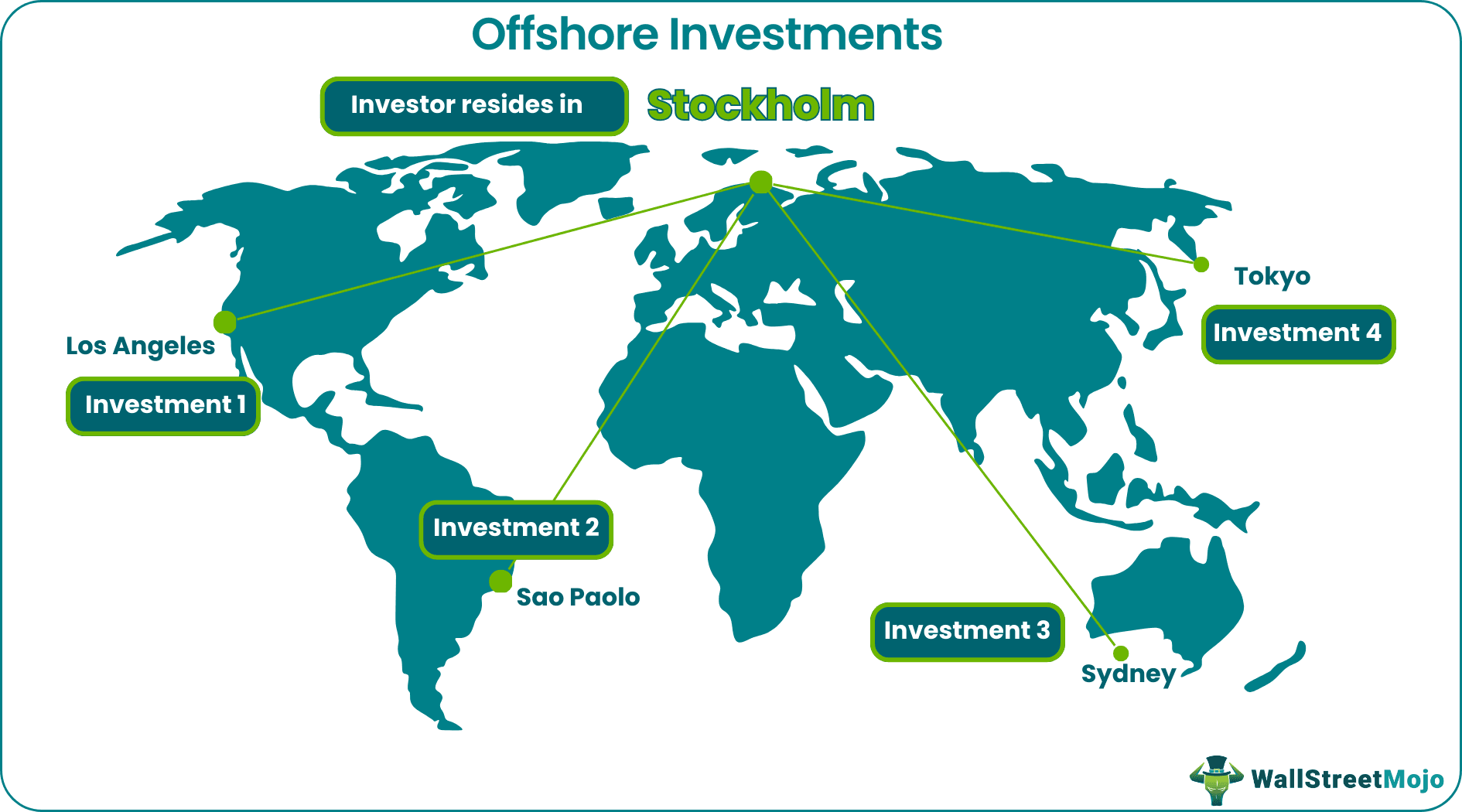

One of the main reasons financiers think about overseas financial investments is the possibility for diversification of their investment portfolio. By designating possessions throughout numerous geographical areas and markets, capitalists can mitigate risks related to focused investments in their home country. This technique is especially important in a significantly interconnected international economy, where economic downturns can have localized impacts.

Offshore financial investments permit people to tap right into arising markets, markets, and money that may not be easily accessible with domestic avenues. Because of this, capitalists can potentially gain from unique growth opportunities and bush versus volatility in their regional markets. Additionally, diversifying right into international assets can decrease exposure to residential economic fluctuations, rates of interest adjustments, and political instability.

In enhancement to geographical diversification, overseas investments usually incorporate a variety of asset courses, such as stocks, bonds, realty, and different financial investments. This multifaceted strategy can enhance risk-adjusted returns and offer a buffer versus market downturns. Eventually, the combination of international direct exposure and varied possession courses positions financiers to attain long-term economic goals while browsing the intricacies of international markets.

Tax Obligation Advantages and Cost Savings

Offshore financial investments additionally supply considerable tax benefits and financial savings, making them an appealing alternative for financiers seeking to optimize their economic techniques. Many territories give desirable tax obligation therapy, enabling financiers to decrease their general tax responsibilities. Particular offshore accounts may make it possible for tax obligation deferral on capital gains up until withdrawals are made, which can be helpful for lasting investment growth.

Furthermore, overseas frameworks can promote estate preparation, allowing people to transfer wealth effectively while decreasing estate tax. By utilizing trust funds or various other vehicles, investors can protect their possessions from excessive taxation and ensure smoother shifts for future generations.

Additionally, some overseas territories enforce little to no income tax, supplying chances for higher returns on investment. This can be especially useful for high-net-worth individuals and corporations seeking to optimize their funding.

Access to International Markets

In addition, spending offshore offers an unique possibility to invest in sectors and fields that are growing in different regions. Technical advancements in Asia or sustainable power campaigns in Europe can offer profitable financial investment alternatives. This geographic diversity not read more just minimizes dependence on domestic economic cycles but likewise mitigates risks connected with localized slumps.

In addition, offshore investment systems typically offer financiers with a broader array of economic instruments, including foreign stocks, bonds, shared funds, and alternate possessions. Such a range allows financiers to tailor their portfolios according to their risk tolerance and investment purposes, enhancing overall portfolio resilience.

Boosted Financial Personal Privacy

While keeping economic personal privacy can be challenging browse around here in today's interconnected globe, overseas investment techniques use a substantial benefit in this respect. Lots of capitalists seek to safeguard their financial details from analysis, and offshore jurisdictions supply lawful frameworks that support discretion.

Offshore accounts and financial investment automobiles usually feature durable personal privacy legislations that limit the disclosure of account information. This is specifically helpful for high-net-worth individuals and businesses looking to safeguard delicate financial information from unwanted attention. Numerous territories likewise provide solid possession protection actions, making sure that assets are secured from potential lawful conflicts or creditors.

In addition, the complexities surrounding global banking laws frequently imply that information shared between jurisdictions is marginal, further boosting privacy. Capitalists can benefit from numerous offshore frameworks, such as trusts or minimal partnerships, which can supply additional layers of personal privacy and safety and security.

It is crucial, nevertheless, for investors to abide with appropriate tax obligation regulations and policies in their home nations when making use of offshore financial investments. By very carefully browsing these requirements, individuals can take pleasure in the advantages of enhanced financial personal privacy while sticking to legal responsibilities. On the whole, overseas investment can serve as an effective device for those seeking discretion in their monetary affairs.

Security Versus Financial Instability

Many financiers identify the relevance of safeguarding their assets against economic instability, and overseas financial investments provide a feasible remedy to this concern (Offshore Investment). As global markets experience changes as a result of political tensions, rising cost of living, and unpredictable financial plans, expanding financial investments throughout boundaries can minimize risk and improve click profile durability

The diversity offered by overseas investments additionally enables accessibility to emerging markets with growth capacity, enabling for tactical positioning in economic climates less impacted by global uncertainties. Because of this, financiers can stabilize their portfolios with possessions that might carry out well throughout residential economic downturns.

Conclusion

To conclude, the consideration of overseas financial investment in the modern economic situation offers various advantages. Diversification of financial investment profiles mitigates dangers connected with residential variations, while tax advantages improve general returns. Accessibility to international markets opens up opportunities for growth, and enhanced monetary personal privacy safeguards possessions. Offshore investments supply critical defense versus financial instability, furnishing financiers with tactical positioning to efficiently navigate uncertainties. In general, the benefits of offshore financial investment are significant and warrant mindful factor to consider.

One of the main reasons capitalists think about overseas investments is the opportunity for diversity of their investment portfolio.In addition to geographical diversity, offshore investments often encompass an array of possession courses, such as supplies, bonds, genuine estate, and alternative financial investments.Offshore financial investments additionally use significant tax obligation advantages and financial savings, making them an eye-catching choice for capitalists seeking to maximize their financial methods.Access to worldwide markets is a compelling benefit of overseas investment strategies that can dramatically improve an investor's portfolio.Offshore investment alternatives, such as international real estate, worldwide shared funds, and international currency accounts, enable investors to secure their properties from local economic declines.

Report this page